What Type of Financial Institution Primarily Provides Mortgages

Contractual institutions insurance companies and pension funds. Savings and Loan Associations.

Requires 5 to open an account.

. Four types of financial institutions are able to become FHLB system members. Market for residential and multifamily mortgagesprovide liquidity to financial. Check Us Out Bank.

Savings wealth liquidity risk credit payment policy. The depository institutions collect the saving from different types of savers and provide long-term or short-term loan to the borrower. 1 DEPOSITORY INSTITUTIONS.

Must keep a minimum of 50000 in account. Mike and Molly really like their financial institution. Mortgage companies concentrate on servicing mortgages rather than investing in mortgages.

Foreign Entity Other. Its Your Money Credit Union. These are the institutions that you might contact to obtain a loan to purchase a home.

Due to commercial banks Commercial Banks A commercial bank refers to a. A mortgage company is an institution that primarily deals with mortgages. Typically they will offer similar services as a retail bank.

This group includes the following Institution Types. They also enjoy the membership that they have at their financial institution. Savings and Loan Holding Companies.

The policy debate. The main depository financial institutions are. Requires 25000 to open an account.

Commercial banks are one of the major financial institutions. Thus they are not as concerned about hedging mortgages over the long run. The ability to open checking and savings accounts provide small business loans and offering other financial products.

A financial instituion that provides loans and mortgages to cu a nonprofit financial institution that is owned by its members A licensed institution that specializes in investing. Similar to other institutions there is a value of the process that takes place. In recent decades nonbank financial institutions have grown substantially.

Most unit trusts are managed by subsidiaries of banks insurance companies or merchant banks. The different types of depository institutions are explained as below. Pays 8 on savings.

These types of. 1 Commercial Banks Commercial banks accept deposits from the public and offer security to their customers. A financial instituion that provides loans and mortgages to customers who hold a saving acount Credit Union a nonprofit financial institution that is owned by.

A commercial bank where most people do their banking is a type of financial institution that accepts deposits offers checking account services makes business personal and mortgage loans and. Depository institutions deposit-taking institutions that accept and manage deposits and make loans including banks building societies credit unions trust companies and mortgage loan companies. Savings banks Financial institution originally set up to provide mortgages and encourage saving which now offers services similar to those of commercial banks.

They are part-owners of the institution and appreciate the great customer service every time they speak with a representative about their financial needs especially in their share account. Explain how a mortgage company s degree of exposure to interest rate risk differs from other financial institutions. A financial institution that accepts deposits primarily from individuals and channels its funds primarily into residential mortgage loans.

The major categories of financial institutions include central banks retail and commercial banks internet banks credit unions savings and loans associations investment banks investment companies brokerage firms insurance companies and mortgage companies. Financial institutions act as intermediaries in the financial market connecting people and companies with parties that can provide the debt and equity they need. Perhaps the most common image people have of financial institutions is the banks and credit.

Seven functions of the global financial system. Today however they provide a. Different types of financial institutions include commercial banks and credit unions.

Broadly speaking there are three major types of financial institutions. Also called thrift institutions and savings and loan associations or SLs were originally set up to encourage personal saving and provide mortgages to local home buyers. Savings and Loans for businesses and individuals.

These include commercial banks savings banks credit unions and savings and loan associations. Pays 25 interest on savings. What type of financial institution primarily provides mortgages.

Specializes in individuals loans and savings. This function has historically occurred primarily in the traditional banking system or other depository institutions which use deposits from consumers as part of the financing to provide multiyear auto or mortgage loans. Cash equities property money market investments mortgages overseas securities.

Unit trusts pool investors funds usually into specific types of assets eg. By contrast certain financial entities that primarily hold mortgages and mortgage-related assets are ineligible to be FHLB members.

Loans Archives Napkin Finance In 2020 Reverse Mortgage Title Insurance Finance Investing

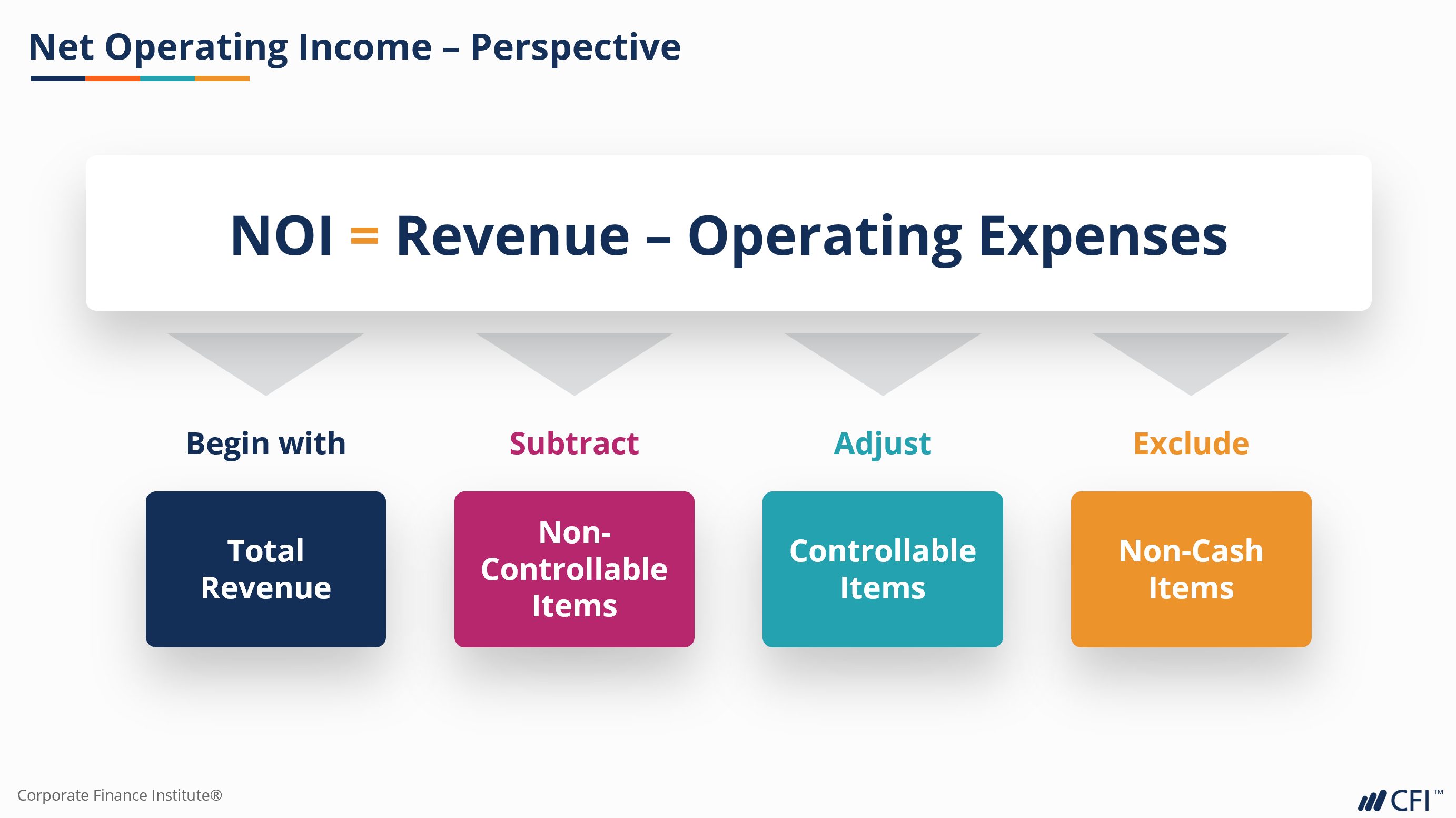

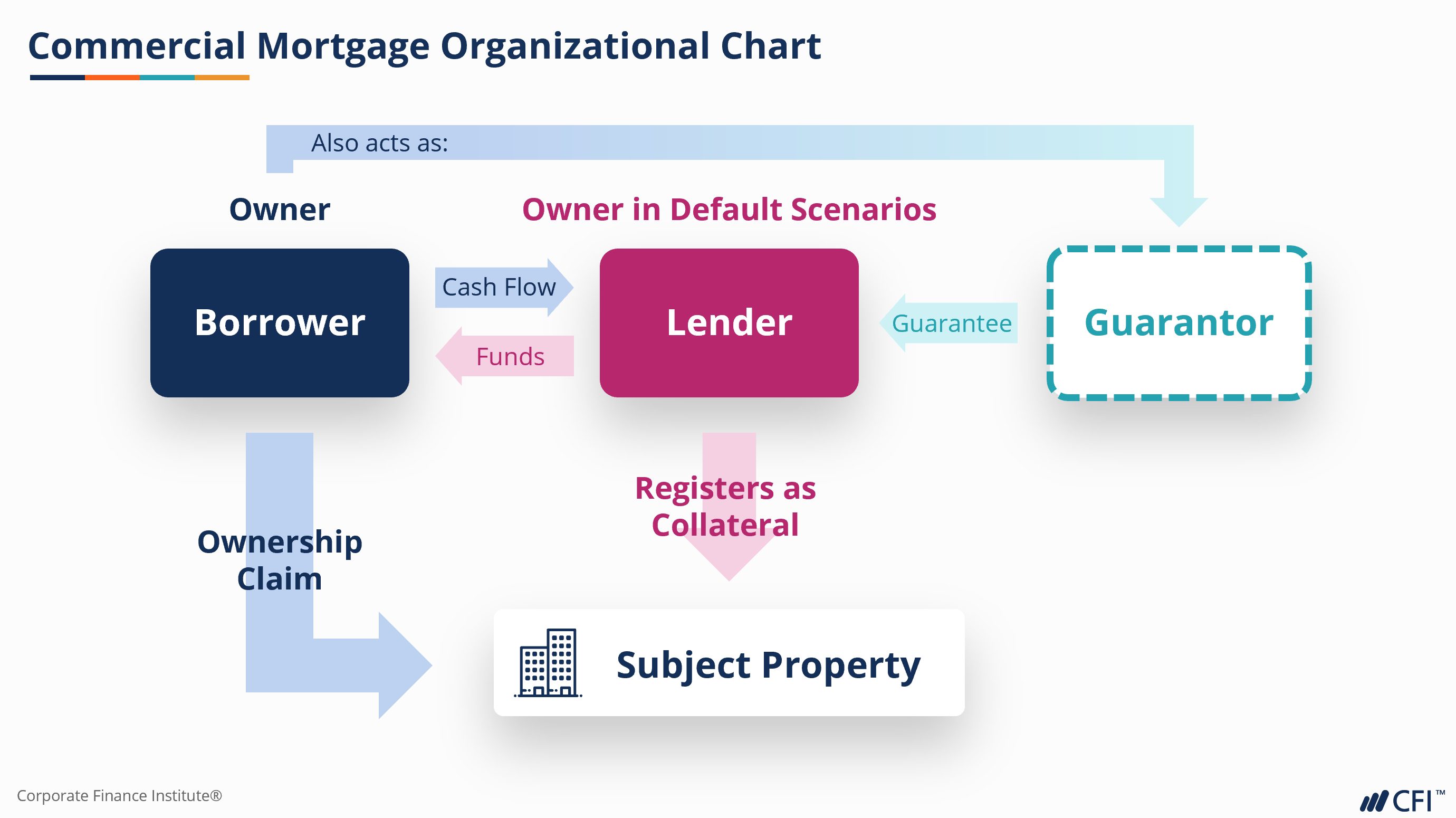

Commercial Mortgages Course Cfi

Commercial Mortgages Course Cfi

:max_bytes(150000):strip_icc()/dotdash_INV_final-The-Risks-of-Mortgage-Backed-Securities-Mar_2021-01-d9076937fc9944049f46c85c78098e39.jpg)

The Risks Of Mortgage Backed Securities

Macropru Macropru On Twitter Embedded Image Permalink Prudential Economics

Home Compare The Best Banks Pnc Financial Services Services Business

Why Do Mortgage Loans Get Transferred Mortgage Loans Mortgage Mortgage Tips

Are Lenders Or Homebuyers Playing It Too Safe With Credit Scores National Mortgage News Credit Score Lenders Home Buying

Chase Bank Statements Statement Template Business Letter Template Bank Statement

The Appealing Download Customer Needs Analysis Style 10 Template For Free In Credit Analysis Report Template Pictur Analysis Cash Management Financial Analysis

Mortgage Definition Overview Examples Types Payments

Wells Fargo History Brand Value And Brand Strategies Wells Fargo Fargo Brand Strategy

Eric Arnold Planswell Manage The Flexible Expenses Financial Planning Organization Education Savings Plan Retirement Calculator

/shutterstock_197115044_mortgage_lender-5bfc317546e0fb00265d0275.jpg)

What Are The Main Types Of Mortgage Lenders

The Appealing Download Customer Needs Analysis Style 10 Template For Free In Credit Analysis Report Template Pictur Analysis Cash Management Financial Analysis

Do You Need Help With Your Credit Score In 2022 Personal Loans Credit Card Student Loans

Pin By Easygallery Changeable Photo On For Mom S Suite Solutions Equity Tax Free

Chase Bank Statements Template Business Statement Template Bank Statement Credit Card Statement

Comments

Post a Comment